Contents

I soon realized that some of the ‘gurus’ were the real deal, and started to pay attention to them to see what they had to offer. I became smarter with my money management, got out of the day trading habit and generally simplified my trading methods so they were easy to implement and Become A Front End Web Developer explain. Hi all, If you know the Power of DIVERGENCE in RSI and Magic of ACCUMULATION/DISTRIBUTION, there is a BULLISH stock for you at throw away price with the chance to run in the upper direction. Normally, I work on future stock, but first time I am shareing in this section.

The second reason is the formation of a bullish divergence around the bottom. Divergence is one of the most prominent signals for a trend reversal as it depicts a reduction in the current momentum and a potential reversal to the opposite one. As can be seen from the chart above, when the stock made a lower low on 29 August 2022, the corresponding RSI failed to follow the price action and made a higher low. This divergence is generally an early indication of a trend reversal of the price.

- It can be measured using various investing software programs and websites.

- When the ROC moves upward, it indicates a significant rise in price, whereas a downward movement depicts a sharp fall in price.

- When it’s negative, the price is below the price “n” periods ago.

- Hi, Can some one please help me with an indicator that alerts on following look for in the chart a divergence between price action and indicator levels.

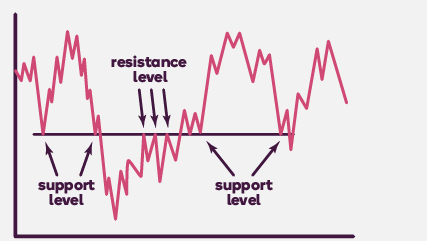

- The Lines of resistance and support inculcate a trustworthy arrangement for indulging the price movements or fluctuations and exploring potential trading prospects.

I now make a living from trading Forex, mainly off the 4hr or Daily charts. Price Data sourced from NSE feed, price updates are near real-time, unless indicated. Financial data sourced from CMOTS Internet Technologies Pvt. Technical/Fundamental Analysis Charts & Tools provided for research purpose.

Desire to Trade Podcast with Etienne Crete

Intercourse of overbought or oversold conditions compromises a strong indication that a price misfortune will occur, alerting traders to potential reversal breakouts resulting from a market correction. The ‘Moving average convergence/divergence is a widespread contrivance for rapidly estimating price movements and fluctuations that supports traders acknowledging the momentum behind a breakout. Through a histogram, traders can see the rapid growth of price changes as price movements slant a line of resistance and break above. With MACD, thoughtful traders can even spot likely occurring breakouts before the price touches the line of resistance based on the rate of the acceleration for the currency pair. Just click on chart button on the result of the screener and see the divergence lines drawn on both stock as well as indicators.

This book has the most successful trading system, clearly explained that can make you a profitable trader/investor. At first there weren’t many reputable brokers around, their platforms were unreliable, spreads were huge and the internet was dial up. But brokers also got smarter and either shut these advantages down or created trading conditions that made it difficult to profit from. Access to is Facebook Group which has new and experienced traders contributing, as well as many YouTube videos to help you out. Finally, the dollar strengthening came to an end from a short term perspective.

When the price steps beyond that line of resistance, it signifies a breakout, exciting many traders to capitalise on this price action and its movements. A breakout is a departure from bounded range price movements and can be triggered by several factors. The most significant to traders is categorising these breakouts when they occur and comprehending the distinction between a false alarm and a correct breakout that offers profitability potential.

The share price of Birlasoft has seen a noticeable plunge from the high of the year, as all IT counters witnessed a selling spree, primarily on account of rising interest rates. However, after a seemingly abating supply near the bottom, the stock is gearing up to stage a successful comeback. It wasn’t easy at first as there weren’t many reputable brokers around and their platforms were unreliable at best. The spreads were huge and the internet was still predominately dial up.

But it’s essential for all market participants to follow the entire calculation process to know about variables that are utilised to ascertain the trend and momentum of a financial instrument. This is one of those indicators that tell the force that is driving in the forex market. In addition, this indicator helps identify when the market will stop in a particular direction and will go for a correction.

Recent Terms

The forums began popping up and the ‘trading gurus’ appeared. There was money to be made by those who were were smart at the time, either by straddling the news releases or exploiting the carry trade. But brokers also got smarter and either shut these advantages down or created trading conditions that made it difficult to profit from them.

Moving Average Convergence Divergence or MACD is one of the most popular financial tools which was created in the 1970’s by Gerald Appel. Moving average convergence divergence or MACD indicates the difference between two moving averages between two time periods of a security’s price. This helps to understand the momentum and strength of the security. Finally, these indicators help to measure the strength of price level changes but do not consider the trajectory of such price movements. Hence, MOM indicators are used alongside other technical analysis tools like moving averages, which can identify trends and price trajectories. Therefore in trading strategy, a trader should focus on buy trades if the price is above the moving average.

I got his another book about FOREX TRADING. This is the one of the best book ever I have seen in my trading career about divergence. After gone through this book I am very clear about false trends which leads to loss. It is god book not only forex markets also it applies to all markets. I first became interested in the Forex markets back in early 2002 when I attended a stock trading meeting at a private residence. One guy announced that he had made a killing by trading the Japanese Yen against the US dollar over a period of about 18 months.

If US inflation stays sticky, 5% peak rate assumption in the US could get challenged. Rate hiking cycle is expected to take a breather in the US in early 2023. There are few episodes in the past where the dollar rally continued despite Fed pivot. And in today’s backdrop, a Fed pivot does not necessarily mean rate cuts. As such, USD can still stay strong versus most major currencies with its relatively high yields and safe-haven status amidst falling global trade and commodity prices. You can also follow other indicators and combine them the same way as explained above for intra-day trading using momentum indicators.

Weekly RSI Positive Divergence

Often regarded as the best momentum indicator, MACD is a trend-following indicator. It represents the relationship between 2 moving averages of a financial instrument’s price. MACD moves back and forth between moving averages and indicates momentum. Usually, ninjatrader broker MACD is calculated by subtracting the 26-day EMA from the 12-day EMA. After this calculation, a 9-day EMA of the MACD, also known as “signal line” is plotted on a graph along with the MACD line. It acts as an indication to all traders whether to buy or sell.

Thus making the indicator better in identifying turning point at the edges and helps trader in identifying trend reversals when comes to discretionary trading. Aggressive rates rise in the US leading to elevated US yields along with monetary policy divergence in key economies are prime factors driving dollar strength. Idiosyncrasies in other safe-haven economies have also made the greenback a unilateral choice during times of faltering growth outlook and reduced risk appetite. Japan’s continuation with yield curve control and deteriorating trade balance has led Yen to lose favour as a safe-haven choice.

Popular in Markets

This signifies that the indicator has stopped tracking the market price movement of a stock. It is a clear signal that the momentum of the market price movement is decreasing. While energy imports are unavoidable, India should keep a close watch on imports of capital goods and intermediates used for big industrial and infrastructure projects. These infra-related imports may drain dollar resources without producing immediate export growth to create necessary dollar earnings.

Did anybody use it for intra-day trading here, in Indian stock market? In forex trading, the stochastic oscillator helps recognize any trends that are likely to be a reversal. A stochastic indicator can measure the momentum by comparing the closing everfx price and the trading range over a certain period. Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market.

In current uncertain times, one should be humble at every expectation and question the assumptions. If geopolitics backdrop becomes averse, investors’ risk aversion could intensify, thereby fuelling the dollar strength. Chinese growth trajectory in 2023 will also be very crucial to shape the commodity outlook.

RSI’s track record of ascertaining overbought and oversold conditions has also been demonstrated in forex indicators and alerts and in other global markets. The RSI is an easily understandable technical indicator that is nevertheless pertinent when an individual is evaluating a potential forex breakout. The RSI uses a 100-point scale to scrutinise purchasing trends and determine whether the conditions for a currency pair are overbought or oversold. The Lines of resistance and support inculcate a trustworthy arrangement for indulging the price movements or fluctuations and exploring potential trading prospects. In forex trading, currency pairs stereotypically see price movements that stay within a stationary range, price extensions and retracements, corresponding to familiar Fibonacci levels.

MACD is arrived at by deducting the exponential moving average of the long-term from the short-term EMA. It is the concept of momentum indicator that is very advantageous as a means of authorisation of a breakout reversal. Ultimately, this indicator displays the highest closing price changes with the lowest price in a certain period. In the New Zealand Dollar and USD chart below, notice how all three of these indicators deal up a buy and earn recommendation around the same time in late March.

If the momentum indicator’s second version is a percentage above 100, the price is above the price “n” periods ago. Secondly, momentum indicators also help the market participants to undertake trading decisions by providing signals which can be identified through the divergence caused by the change in price. RSI is one of the most popular MOM indicators among traders.